UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | |

Filed by the Registrantý |

Filed by a Party other than the Registranto¨ |

Check the appropriate box: |

o¨ |

|

Preliminary Proxy Statement |

o¨ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o¨ |

|

Definitive Additional Materials |

o¨ |

|

Soliciting Material under §240.14a-12

|

| | | | |

| AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required.required |

o¨ |

Fee paid previously with preliminary materials |

| ¨ |

Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.0-11 |

| | (1) | | Title of each class of securities to which transaction applies:

|

| | (2) | | Aggregate number of securities to which transaction applies:

|

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | (4) | | Proposed maximum aggregate value of transaction:

|

| | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | (2) | | Form, Schedule or Registration Statement No.:

|

| | (3) | | Filing Party:

|

| | (4) | | Date Filed:

|

Table of Contents

AMERICAN EQUITY

INVESTMENT LIFE HOLDING COMPANY

6000 Westown Parkway

West Des Moines, Iowa 50266

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

June 4, 2020

| | |

Meeting Date:

| | Thursday, June 4, 2020 |

Time: |

|

1:30 p.m., Central Daylight Time |

Location: |

|

6000 Westown Parkway, West Des Moines, IA 50266

|

The Annual Meeting of Shareholders of American Equity Investment Life Holding Company will be held for the following purposes:

1.To elect five directors to three-year terms and one director to a two-year term.

2.To ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2020.

3.To hold an advisory vote to approve the compensation of our named executive officers.

4.To approve the American Equity Investment Life Holding Company Amended and Restated Equity Incentive Plan.

5.To transact such other business that may properly come before the meeting.Shareholders of record at the close of business on the record date, April 9, 2020, are entitled to the notice of and to vote at the meeting. It is important that your shares be represented and voted at the meeting. Whether or not you plan to attend the meeting, please vote your shares in one of the following ways:

[This page intentionally left blank]

| | | | |

Telephone | | Internet | | Mail |

| |  | |  |

By telephone; |

|

Through the Internet; or |

|

If you received a paper copy of the proxy statement, by completing, signing and promptly returning the enclosed proxy card in the enclosed postage-paid envelope.2022 Proxy Statement |

We intend to hold our Annual Meeting in person. However, as part of our precautions regarding the coronavirus or COVID-19 pandemic, we are planning for the possibility that the Annual Meeting may be held by means of remote communication. If we take this step, we will announce the decision to do so in advance, and details on how to participate will be available on our website at www.american-equity.com and filed with the Securities and Exchange Commission as proxy material.

By Order of the Board of Directors

Renee D. Montz

SecretaryWest Des Moines, Iowa

April 24, 2020

Table of Contents

PROXY STATEMENT

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

Annual Meeting of Shareholders

June 4, 2020

Table of Contents

| | | | |

Annual Meeting and Proxy Solicitation Information

| | 1 | |

| | 2022 Proxy Statement |

A Note About Financial Measures

We report certain performance measures we do not calculate in accordance with accounting principles generally accepted in the United States of America (GAAP). We do not present these as substitutes for the most directly comparable GAAP measures:

| | | | | |

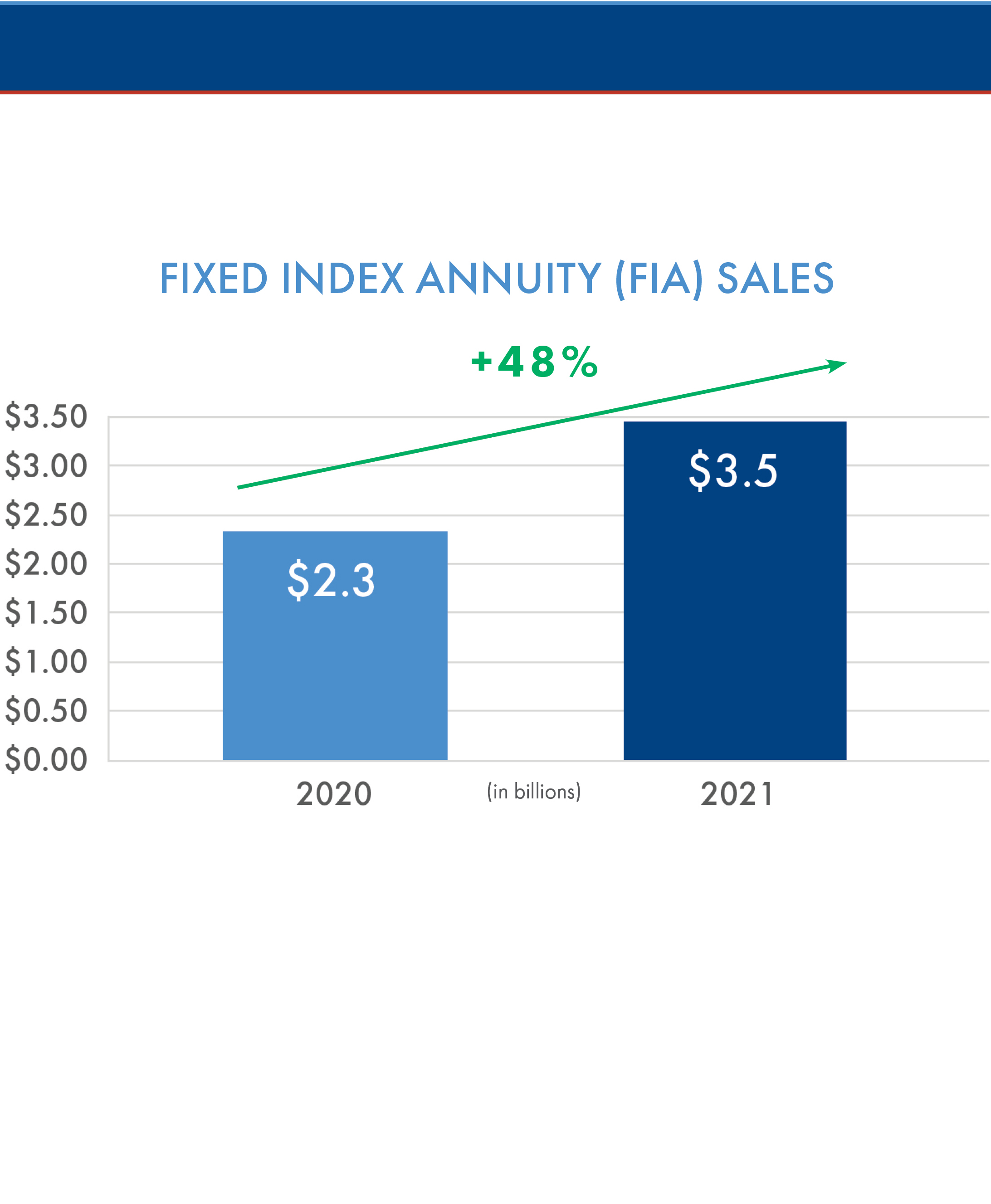

| (dollars in thousands, except per share data) | 2021 |

| Net income (loss) available to common stockholders | 430,317 | |

| Net income (loss) available to common stockholders per diluted common share | 4.55 |

| | | | | | | | |

| 2018 | 2021 |

| Total stockholders' equity | 2,399,101 | 6,323,127 |

| Book value per common share | 26.55 | 60.78 |

See Appendix A for further information.

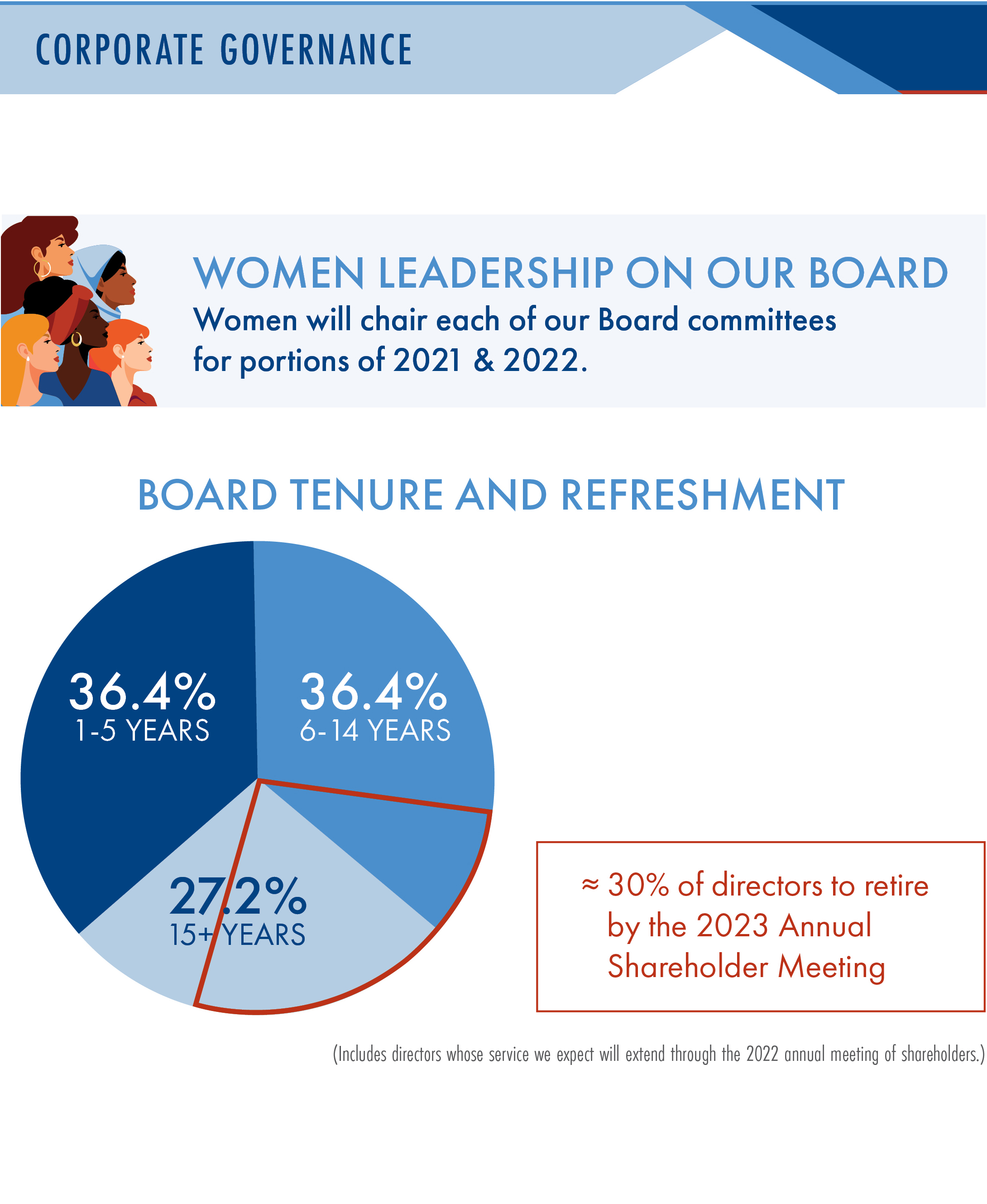

(includes directors whose service we expect will extend through the 2022 annual shareholder meeting)

[This page intentionally left blank.]

AMERICAN EQUITY

INVESTMENT LIFE HOLDING COMPANY

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

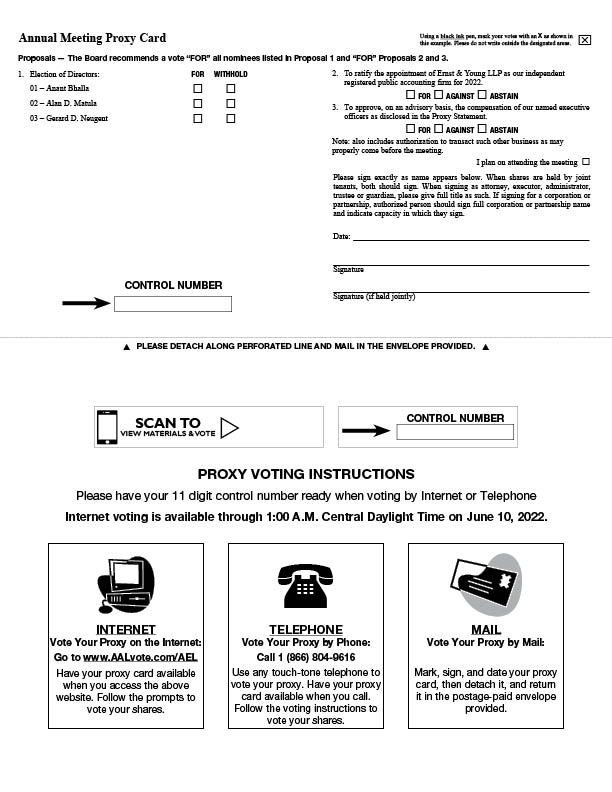

| | | | | | | | | | | |

| | | Items of Business |

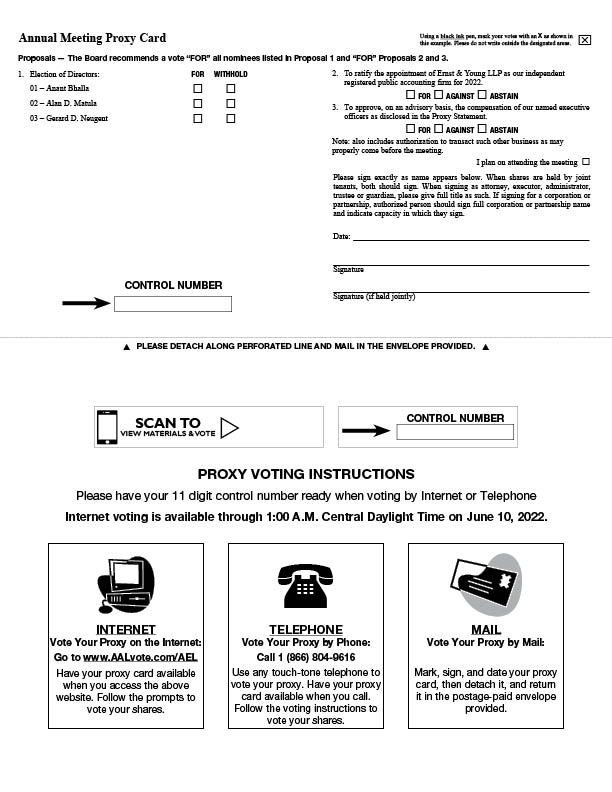

| Thursday, June 10, 2022

8:30 a.m., Central Daylight Time | | 1.To elect three directors to three-year terms. |

| 6000 Westown Parkway

West Des Moines, IA 50266

(our principal executive offices) | | 2.To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2022 (advisory vote). |

Record Date Shareholders of record at the close of business on the record date, April 12, 2022, are entitled to the notice of and to vote at the meeting. | | 3.To approve the compensation of our named executive officers as disclosed in this proxy statement (advisory vote). |

| 4.To transact such other business that may properly come before the meeting. |

| Vote Your Shares | | Information about these matters is in the accompanying proxy statement.

|

| BY TELEPHONE: 1 (866) 804-9616 | | Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on June 10, 2022 The accompanying Proxy Statement, 2021 Annual Report to Shareholders, and 2022 CEO Letter to Shareholders are available at http://www.viewproxy.com/americanequity/2022.

| | 1 | We have outstanding awards representing 1,033,420 shares of our common stock (including both options and share awards) in exchange for past or future services.

Under limited circumstances, our directors are entitled to indemnification from us under applicable law and our bylaws. |

General Information

| ONLINE: www.AALvote.com/AEL | 1 | |

Voting Rights

| BY MAIL: If you received a paper copy of the proxy statement, you may vote by completing, signing and promptly returning the enclosed proxy card in the enclosed postage-paid envelope. | 1 | |

Voting

| | 2 | |

Proposal 1—Election of Directors

| | 3 |

| | | | | | | | | | | | | | |

Class I Director Nominated for a Term that Expires at the 2022 Annual Meeting

| | 3 | |

Class II Directors Nominated for a Term that Expires at the 2023 Annual Meeting

| | 3 | |

Class III Directors Whose Terms Expire at the 2021 Annual Meeting

| | 4 | |

Class I Directors Whose Terms Expire at the 2022 Annual Meeting

| | 5 | |

Board and Corporate Governance Information

| | 6 | |

Corporate Governance

| | 6 | |

Board Leadership Structure

| | 6 | |

Board of Directors' Oversight of Risk Management

| | 6 | |

Majority of Independent Directors

| | 7 | |

Meetings and CommitteesBy Order of the Board of Directors Phyllis Zanghi Chief Legal Officer and Secretary

| | 7 |

| | | | | | | | |

TABLE OF CONTENTSInformation Regarding the Company's Process for Identifying Director Nominees

| | 92022 Proxy Statement |

[This page intentionally left blank.]

| | | | | | | | |

| | 10 | |

Director Stock Ownership Guidelines

| | 10 | |

Director Compensation

| | 10 | |

Proposal 2—Ratification of Appointment of Independent Registered Public Accounting Firm

| | 13 | |

Audit Committee Disclosures

| | 14 | |

Executive Officers and Compensation

| | 15 | |

Executive Officers

| | 15 | |

Compensation Discussion and Analysis

| | 16 | |

Compensation Committee Report

| | 25 | |

Executive Compensation Tables

| | 26 | |

Option Exercises and Stock Vested

| | 29 | |

Potential Payments Upon Termination or a Change in Control

| | 29 | |

CEO Pay Ratio

| | 31 | |

Proposal 3—Advisory Vote on Executive Compensation

| | 32 | |

Proposal 4—Approval of the American Equity Investment Life Holding Company Amended and Restated Equity Incentive Plan

| | 33 | |

Additional Information

| | 39 | |

Security Ownership of Management and Certain Beneficial Owners

| | 39 | |

Equity Plan Information

| | 40 | |

Related Person Transaction Disclosures

| | 41 | |

Section 16(a) Beneficial Ownership Reporting Compliance

| | 42 | |

Shareholder Proposals for 2021 Annual Meeting

| | 42 | |

Shareholder Communications

| | 42 | |

Householding; Annual Report on Form 10-K

| | 43 | |

Appendix A—American Equity Investment Life Holding Company Amended and Restated Equity Incentive Plan

| | A-1 | 2022 Proxy Statement |

Table of Contents

Annual Meeting andOur Proxy

Solicitation InformationStatement

A Notice Regarding the Availability of Proxy Materials

American Equity Investment Life Holding Company, 6000 Westown Parkway, West Des Moines, Iowa 50266 (referred to inWe are providing this proxy statement, as the "Company" or as "we," "our" or "us") is using "notice and access" to distribute proxy materials to shareholders, which means this proxy statement and the Company's Annual Report to Shareholders will be made available on the Internet instead of mailing a printed copy to each shareholder. Shareholders who receive a Notice of Internet Availability of Proxy Materials (the "Notice") by mail will not receive a printed copy of these materials other than as described below. The Notice contains instructions as to how shareholders may access and review all of the important information contained in the materials on the Internet, including how to submit proxies. The Notice is first being mailed on or aboutdated April 24, 2020.

If you would prefer to receive a printed copy of the Company's proxy materials, please follow the instructions for requesting printed copies included in the Notice. Shareholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. Choosing to receive future proxy materials by email will save the Company the cost of printing and mailing documents to shareholders and will reduce the impact of the annual meeting on the environment. A shareholder's election to receive proxy materials by email will remain in effect until the shareholder terminates it.

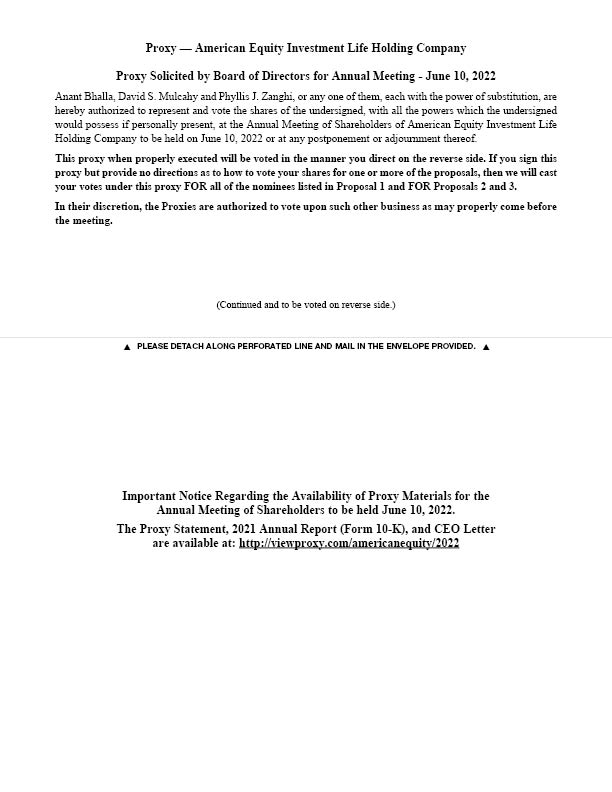

General Information

This proxy statement is provided27, 2022, to the shareholders of the Company in connection with the solicitation of proxies by the Board of Directors for the annual meeting of shareholders to be held on June 4, 2020 ("10, 2022 (Annual Meeting"Shareholder Meeting), at the time and place shown in the Notice of Annual Meeting of Shareholders, and at any adjournment. To obtain directions to the Annual Shareholder Meeting, you may contact us at our toll-free number: 1-888-221-1234.

We will bear all expenses in connection with this solicitation. Proxies may be solicited by the Board of Directors or management personally, telephonically or electronically.

Voting Rights

Only shareholders of record as of the close of business on April 9, 2020 will be entitled to the notice of and to vote at the Annual Meeting. We have a single class of voting common stock, $1 par value per share ("Common Stock"), of which 91,524,623 shares were outstanding and entitled to vote on such date. Each share is entitled to one vote.

Shares present in person or represented by proxy at the Annual Meeting will be tabulated to determine if a quorum is present. A quorum is present if a majority of the votes entitled to be cast on a matter are represented for any purpose at the Annual Meeting. Votes withheld for any director, broker non-votes and abstentions represented at the Annual Meeting will be counted for quorum purposes. Votes will be tabulated under the supervision of Alliance Advisors, L.L.C., which has been designated by the Board of Directors as inspector of the election.

If your shares of Common Stock are held in the name of a bank, broker or other holder of record, you will receive instructions from that holder to vote your shares at the Annual Meeting. Contact your bank, broker or other holder of record directly if you have any questions. Even if you do not provide instructions, your bank, broker or other holder of record may vote your shares on certain "routine matters." The New York Stock Exchange ("NYSE") considers Proposal 2 to be a "routine matter." As a result, without instructions from you, your broker is permitted to vote your shares on this matter at its discretion. A broker non-vote occurs when a broker does not vote on some matter because the broker has not received instructions from you and does not have discretionary voting power for that particular item. Proposals 1, 3 and 4 are considered "non-routine matters" and, therefore, brokers may not vote on these matters unless they receive specific voting instructions from you.

If you plan to attend the Annual Meeting and vote in person, you will have the opportunity to obtain a ballot when you arrive. If your shares of Common Stock are not registered in your own name and you plan to attend the Annual Meeting and vote your shares in person, you will need to contact the broker or agent in whose name your shares are registered to obtain a broker's proxy card. You will need to bring the broker's proxy card with you to the Annual Meeting in order to vote.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020 Proxy Statement |

|

1 |

Table of Contents

Voting

If you vote by proxy, the individuals named on the proxy card (your proxies) will vote your shares in the manner you indicate. If you sign, date and return the proxy card without indicating your instructions on how to vote your shares, the proxies will vote your shares as follows:

•"FOR" the election of the six director nominees;

•"FOR" the ratification of the appointment of KPMG LLP ("KPMG") as our independent registered public accounting firm for 2020;

•"FOR" the approval of the compensation of our named executive officers as disclosed inIn this proxy statement, pursuant"we," "our," "us," and their derivative forms, and the "Company," refer to the compensation disclosure rules of the Securities and Exchange Commission ("SEC"); andAmerican Equity Investment Life Holding Company.

•"FOR" the approval of the Company's Amended and Restated Equity Incentive Plan.If any other matter is presented at the Annual Meeting, your proxies will vote in accordance with their best judgment. At the time this proxy statement was printed, we knew of no other matters to be addressed at the Annual Meeting.

If you are a registered shareholder (that is, you own shares of Common Stock in your own name and not through a broker, nominee or in some other "street name"), you may vote by telephone, through the Internet or by obtaining a proxy card and returning it by mail. Please see the Notice for instructions on how to access the telephone and Internet voting systems. If you hold your shares in "street name," your broker or other nominee will advise you on whether you may vote by telephone or through the Internet as an alternative to voting by proxy card.

A proxy may be revoked at any time prior to the close of voting at the Annual Meeting. Such revocation may be made in person at the Annual Meeting, by notice in writing delivered to the Corporate Secretary of the Company, by voting by telephone or through the Internet at a later date or by a proxy bearing a later date.

The Board of Directors urges you to take advantage of internet or telephone voting. Instructions are included in the Notice or the proxy card.

| | | | | | | | |

| | 2022 Proxy Statement |

|

|

|

|

|

|

[This page intentionally left blank.]

Table of Contents

Proposal

1—1Election of Directors

The Board of Directors presently consists of twelve members. Each member of the

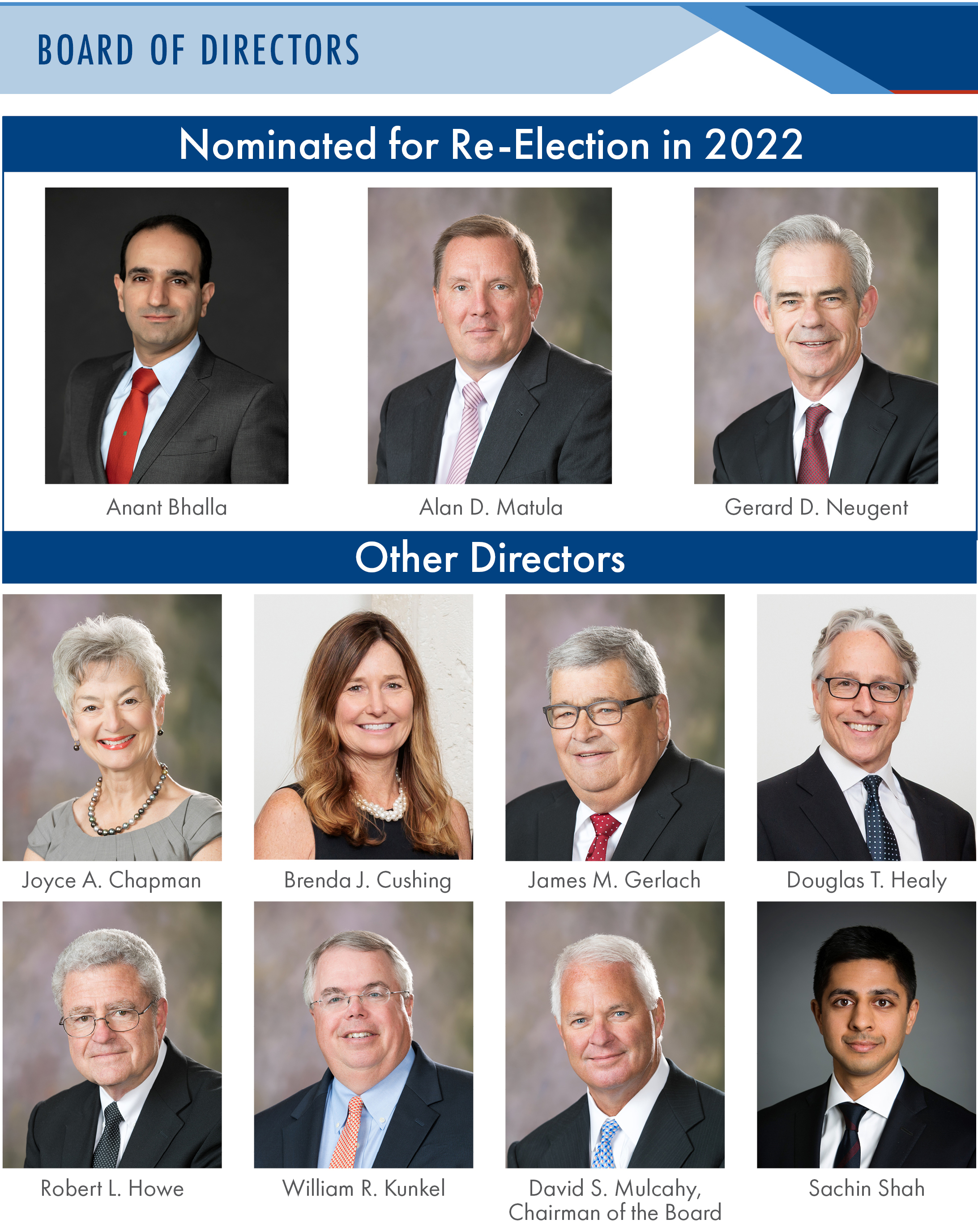

Our Board of Directors has

been appointed to one ofnominated three

classes with three-yearcurrent directors whose terms

expiring on a staggered basis. The terms of the five directors presently serving as the Class II Directors expire at the

Annual Meeting, along with the term of one director presently serving as a Class I Director.The nominees to serve as Class II Directors are Joyce A. Chapman, James M. Gerlach, Robert L. Howe, Michelle M. Keeley, and William R. Kunkel. Each is nominated2022 annual shareholder meeting for a term of three years expiringnew terms ending at the 2025 annual meeting of shareholders in 2023, or until their respective successors are elected and qualified, subject to their prior death, resignation or removal. Ms. Keeley is standing for election as a Class II Director to replace Debra J. Richardson, who presently serves as a Class II Director and is not standing for reelection at the Annual Meeting.

Mses. Chapman and Keeley and Messrs. Gerlach, Howe and Kunkel are independent under the requirements of the Sarbanes-Oxley Act of 2002 ("SOX"), and rules adopted by the SEC, as well as the corporate governance listing standards of the NYSE ("NYSE Rules").

On January 8, 2020, the Board of Directors increased its size from eleven to twelve directors effective January 27, 2020. shareholder meeting:

•Anant Bhalla was appointed by the Board of Directors to fill the vacancy created by the increase in the number of, also our President and Chief Executive Officer;

•Alan D. Matula, an independent director; and

•Gerard D. Neugent, an independent director.

Shareholders elect directors

and to serve on the Executive and Investment Committees. Mr. Bhalla's initial term expires on the date of the Annual Meeting and he serves as a Class I Director. He is nominated for a term of two years expiring at the annual meeting of shareholders in 2022, or until his successor is elected and qualified, subject to his prior death, resignation or removal.The Board of Directors anticipates the nominees will serve. In the event a nominee is unable to do so, proxies will be voted for such substitute nominee as the Board of Directors in its discretion may recommend. Proxies will be voted for the election of the nominees unless the shareholder giving the proxy withholds authority or votes against any nominee.

Directors are elected by a plurality vote of the votes cast by the shares of our common stock entitled to vote at the Annual Meeting.

The2022 annual shareholder meeting.

Our Board of Directors unanimously recommends you vote FOR theits nominees, listed below.Mr. Bhalla, Mr. Matula, and Mr. Neugent.

Directors

Directors Nominated for a Term that Expires at the

20222025 Annual Meeting

Anant Bhalla, 42,44, has served as a Directordirector since January 2020. Effective January 27, 2020, Mr. Bhalla was appointed our President, of the Company, and effective March 1, 2020, he was appointed our Chief Executive Officer. Prior to that, Mr. Bhalla was a partner of Bhalla Capital Partners from March 2019 to January 2020. From 2016 until 2019, he served as Executive Vice President and Chief Financial Officer of Brighthouse Financial, Inc., an insurance and financial services company. From 2014 until 2016, he served as Chief Financial Officer of Retail businessBusiness for MetLife.MetLife, a insurance and financial services company. Prior to MetLife, Mr. Bhalla served in numerous senior roles including Chief Risk Officer, Treasurer, and other management roles at Fortune 500 companies, including American International Group, Lincoln National Corporation, and Ameriprise Financial.Financial Services. Mr. Bhalla'sBhalla is also director of the Greater Des Moines Partnership, an economic and community development organization. Our Board of Directors concluded that Mr. Bhalla should serve as a director in light of his financial expertise, proven public company strategic leadership, and extensive knowledge of, and background in, the Company'sour industry and business ledbusiness.

Class I

Alan D. Matula, 61, has served as a director since December 2015. He has served as the Chief Information Officer of Weber-Stephen Products LLC, a privately owned company that manufactures charcoal, gas and electric outdoor grills and accessories, since December 2015. Mr. Matula worked for the Royal Dutch Shell plc organization, an energy company, for over 30 years. During that time, he served in various information technology capacities for the parent company and several of its subsidiaries, including Chief Information Officer for Royal Dutch Shell plc from 2006 to 2015. Our Board of Directors to concludeconcluded that Mr. BhallaMatula should serve as a director in light of his financial expertise, proven public company strategic experience as chief information officer overseeing technology and cyber-related risks, as well as his deep business experience.

Nominating and Corporate Governance Committee, Audit and Risk Committee; Class I

Gerard D. Neugent, 70, has served as a director since 2010. Mr. Neugent is a manager of William C. Knapp, LC, builders, since 2008. He also was a member of that company from 2008 until 2021 when he transferred his ownership of 4.8% to a trust for the Company.benefit of his immediate family. He has served Knapp Properties, L.C. as Co-Chairman since 2017, and Knapp Properties, Inc. (Member:Knapp Properties), a real estate development, management and brokerage business, as Chief Executive Officer from 2014 until 2020, as President from 2014 until 2017, and as President and Chief Operating Officer from 1993 until 2014. His primary duties there included real estate transactions, development and management. Mr. Neugent received his law degree from Drake University. Our Board of Directors concluded that Mr. Neugent should serve as a director in light of his experience in real estate and business management as well as his legal background.

Investment

CommitteesCommittee, Nominating and Corporate Governance Committee; Class III

Other Directors

Nominated for a Term that Expires at the 2023 Annual Meeting Joyce A. Chapman, 75,77, has served as a director since 2008. She worked for over 35 years with West Bank, West Des Moines, Iowa until her retirement in 2006. While at West Bank, Ms. Chapman served in various capacities related to bank administration and operations. From 1975 until her retirement from the board in 2018, Ms. Chapman served as a director for West Bank and West Bancorporation, Inc., a banking and trust services business, from 1975 until her retirement from its board in 2018. Ms. Chapman has served in numerous positions of leadership in philanthropic and banking industry organizations. Our Board of Directors concluded that Ms. Chapman's leadershipChapman should serve as a director in light of her experience in various organizations and her experience in the banking industry led the Board of Directors to conclude that Ms. Chapman should serve as a director of the Company.industry. Compensation and

Talent Management Committee, Nominating and Corporate Governance

Committees

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020 Proxy Statement |

|

3 |

Table of Contents

James M. Gerlach, 78, has served as a director since 1996. He served as Executive Vice President of the Company from 1996 until his retirement in 2011. Prior to joining the Company, Mr. Gerlach served as Executive Vice President of American Life and Casualty Insurance Company, a wholly-owned subsidiary of The Statesman Group, Inc. ("Statesman"), and as Executive Vice President and Treasurer of Vulcan Life Insurance Company, a subsidiary of American Life and Casualty Insurance Company. Mr. Gerlach was active in the insurance industry for over 45 years. Mr. Gerlach's knowledge of the Company's operations as well as his years of experience in the insurance industry led the Board of Directors to conclude that Mr. Gerlach should serve as a director of the Company.

Robert L. Howe, 77, has served as a director since 2005. He is our Lead Independent Director. He served the State of Iowa Insurance Division from 1964 to 2002 in various capacities. He was named Deputy Commissioner and Chief Examiner in 1985 and served in that position until his retirement in 2002. During this time, Mr. Howe was responsible for the financial oversight of 220 domestic insurance companies. Since his retirement, Mr. Howe has been a self-employed insurance consultant. Mr. Howe served as a director of EMC National Life Company from 2003 until 2007, and, from 2007 until 2018, Mr. Howe served as a director of EMC Insurance Group. He also served as the designated financial expert on the board of directors of EMC Insurance Group. Mr. Howe is a certified financial examiner, certified insurance examiner, certified government financial manager and accredited insurance receiver. Mr. Howe's experience in the financial oversight of insurance companies and his expertise in finance led the Board of Directors to conclude that Mr. Howe should serve as a director of the Company.

Michelle M. Keeley, 55, is a retired Executive Vice President of equities and fixed income investments for RiverSource Investments, LLC, the asset management division of Ameriprise Financial Services. Ms. Keeley worked for American Express and its publicly-traded spin-off, Ameriprise Financial Services, from 2002 to 2010. Prior to joining American Express, Ms. Keeley was a managing director with Zurich Global Assets from 1990 to 2002. In November 2014, Ms. Keeley was elected to serve as an independent director on the board of the Federal Home Loan Bank of Des Moines. Currently, she serves as chair of the human resources and compensation committee and a member of the finance and planning and executive committees for the board of the Federal Home Loan Bank of Des Moines. In 2015, Ms. Keeley became a director of the Bridge Builder Mutual Fund Series, an affiliated company of Edward Jones Financial Services. Ms. Keeley serves on all committees of the board of the Bridge Builder Mutual Fund Series. Ms. Keeley's executive experience in capital markets and financial services, as well as her board experience with a bank and a mutual fund company led the Board of Directors to conclude that Ms. Keeley should serve as a director of the Company.

William R. Kunkel, 63, has served as a director since June 2016. He has served as General Counsel of the Archdiocese of Chicago since November 2016. From 2012 through April 1, 2016, he served as the Company's Executive Vice President, Legal and General Counsel. Prior to joining the Company, Mr. Kunkel was a partnerCommittee; Class II, term expires at the international law firm of Skadden, Arps, Slate, Meagher & Flom LLP for over 25 years, where he focused his practice on mergers and acquisitions, corporate finance and other corporate governance and securities matters. Mr. Kunkel's experience as an executive of the Company and as legal counsel to the Company as well as his expertise in corporate governance and corporate finance led the Board of Directors to conclude that Mr. Kunkel should serve as a director of the Company.

Class III Directors Whose Terms Expire at the 2021 Annual Meeting

2023 annual shareholder meeting

Brenda J. Cushing, 56,58, has served as a director since March 2017. Ms. Cushing has been an independent insurance consultant since August 2015. From August 2014 to August 2015, Ms. Cushing served as Executive Vice President and Chief Financial Officer of Athene Holding Ltd., a retirement services company, and from October 2013 to August 2014, Ms. Cushing served as Executive Vice President and Chief Financial Officer of Athene USA Corp., a subsidiary of Athene Holding Ltd. From 2008 until its acquisition by Athene Holding Ltd. in 2013, Ms. Cushing served as Executive Vice President and Chief Financial Officer of Aviva USA Corp., a diversified financial company that offered long-term savings, insurance and retirement income products. Ms. Cushing is a certified public accountant (inactive) and has been involved in the insurance industry for over 2025 years. Ms. Cushing'sCushing also serves as Director of MercyOne Des Moines (a medical center and hospital not-for-profit), Bankers Trust (a bank), and Merchants Bonding (a surety bond company). Our Board of Directors concluded that Ms. Cushing should serve as a director in light of her financial expertise and insurance company financial leadership for over two decades leddecades.

Audit and Risk Committee, Compensation and Talent Management Committee; Class III, term expires at the 2024 annual shareholder meeting

James M. Gerlach, 79, has served as a director since 1996. He served as our Executive Vice President from 1996 until his retirement in 2011. Prior to joining us, Mr. Gerlach served as Executive Vice President of American Life and Casualty Insurance Company, a wholly-owned insurance subsidiary of Statesman, and as Executive Vice President and Treasurer of Vulcan Life Insurance Company, an insurance subsidiary of American Life and Casualty Insurance Company. Mr. Gerlach was active in the insurance industry for over 45 years. Our Board of Directors to concludeconcluded that Ms. CushingMr. Gerlach should serve as a director in light of his knowledge of our operations as well as his years of experience in the insurance industry.

Class II, term expires at the 2023 annual shareholder meeting

Douglas T. Healy, 57, has served as a director since September 2020. Mr. Healy currently serves as a senior advisor to a number of companies in the financial, technology and non-profit sectors. Prior to his current activities, Mr. Healy had more than 30 years of senior leadership experience at major financial and asset management firms including Credit Suisse, AXA Investment Managers and CS First Boston. He has a deep knowledge of the Company.insurance industry, investment strategy, and asset allocation. Mr. Healy is a Chartered Financial Analyst and also serves as Director and Treasurer of The Eagle Academy Foundation. Our Board of Directors concluded that Mr. Healy should serve as a director in light of his financial and insurance expertise and asset management firm leadership for over 30 years. Investment Committee, Audit and Compensation CommitteesRisk Committee; Class III, term expires at the 2024 annual shareholder meeting

|

|

|

|

|

|

|

|

|

|

|

20202022 Proxy Statement |

|

|

|

|

|

|

Robert L. Howe

Table, 79, has served as a director since 2005. He served the State of ContentsIowa Insurance Division, the state's insurance regulator, from 1964 to 2002 in various capacities. He was named Deputy Commissioner and Chief Examiner in 1985 and served in that position until his retirement in 2002. During this time, Mr. Howe was responsible for the financial oversight of 220 domestic insurance companies. Since his retirement, Mr. Howe has been a self-employed insurance consultant. Mr. Howe served as a director of EMC National Life Company, from 2003 until 2007, and, from 2007 until 2018, as a director of EMC Insurance Group, an insurance organization. He also served as the designated financial expert on the board of directors of EMC Insurance Group. Mr. Howe is a certified financial examiner, certified insurance examiner, certified government financial manager and accredited insurance receiver. Our Board of Directors concluded that Mr. Howe should serve as a director in light of his experience in the financial oversight of insurance companies and his expertise in finance.

Investment Committee, Audit and Risk Committee; Class II, term expires at the 2023 annual shareholder meeting

William R. Kunkel, 65, has served as a director since June 2016. He served as General Counsel of the Archdiocese of Chicago, a religious organization, from November 2016 until July 31, 2020. From 2012 through April 1, 2016, he served as our Executive Vice President, Legal and General Counsel. Prior to joining us, Mr. Kunkel was a partner at the law firm of Skadden, Arps, Slate, Meagher & Flom LLP for over 25 years, where he focused his practice on mergers and acquisitions, corporate finance and other corporate governance and securities matters. Our Board of Directors concluded that Mr. Kunkel should serve as a director in light of his experience as an executive of ours and as legal counsel to us, as well as his expertise in corporate governance and corporate finance.

Class II, term expires at the 2023 annual shareholder meeting

David S. Mulcahy, 67,69, has served as a director since 2011. Mr. MulcahyHe has served as our independent Chairman of the Board of Directors since April 2021 and served as our Audit Committee Chairman from 2011 to 2021. He previously served as a member of the Company'son our Board of Directors from 1996 to 2006. Mr. Mulcahy has served as non-executive Chairman of the board of Workiva Inc. (NYSE: WK), a technology company, since June 2018, and as a member of its board of directors since 2014. He served as chairman of its compensation committee from 2014 to 2018. Workiva Inc. is a provider of cloud-based compliance and regulatory reporting solutions serving a global client base, including some of the largest companies in the U.S. Mr. Mulcahy is the chairman of Monarch Materials Group, Inc., which manufactures and sells building products into the concrete construction industry. Mr. Mulcahy also serves as president and chairman of the board of directors of MABSCO Capital, Inc., which provides portfolio management services. Mr. Mulcahy is an active investor in private companies and previously managed private equity capital for numerous banks and insurance companies. He is a certified public accountant (inactive) who was a partner with Ernst & Young (EY), where he specialized in mergers and acquisitions. Mr. Mulcahy is a graduate of the University of Iowa. Our Board of Directors concluded that Mr. Mulcahy should serve as a director in light of his valuable perspective and extensive background and experience in business management, financial reporting and accounting.

Nominating and Corporate Governance Committee; Class III, term expires at the 2024 annual shareholder meeting

Sachin Shah, 45, has served as a director since November 2020. Mr. Shah currently is Managing Partner, Chief Investment Officer of Brookfield Asset Management Inc., and Vice Chair of Brookfield Renewable Group. Since 2002, Mr. Shah has been with Brookfield Asset Management Inc., a global alternative asset manager with assets under management across its real estate, infrastructure, renewable power, private equity, and credit strategies. He has held a variety of senior roles across that organization, including Chief Executive Officer of Brookfield Renewable Partners from 2015 to 2020. Our Board of Directors concluded that Mr. Shah should serve as a director in light of his financial and asset management expertise and experience.

Class III, term expires at the 2024 annual shareholder meeting

Director Qualifications and Experience

Our Board believes that the director nominees and other directors are knowledgeable, skilled, and qualified to oversee our evolving business, and that our Board will continue to be well-equipped to vigorously exercise its role.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bhalla | Chapman | Cushing | Gerlach | Healy | Howe | Kunkel | Matula | Mulcahy | Neugent | Shah |

| Financial Services | ✓ | ✓ | ✓ | | ✓ | | ✓ | | ✓ | | |

| Insurance | ✓ | | ✓ | ✓ | ✓ | ✓ | ✓ | | | | |

| Risk Management | ✓ | | ✓ | | ✓ | | ✓ | ✓ | ✓ | ✓ | |

| Financial Reporting/Accounting | ✓ | ✓ | ✓ | ✓ | | ✓ | | | ✓ | | ✓ |

| Brand and Marketing | ✓ | ✓ | | | | | | ✓ | ✓ | | |

| Executive Compensation | | | | | | | ✓ | | ✓ | ✓ | |

| Human Resources/Talent Management | ✓ | ✓ | ✓ | | | | | ✓ | | | |

| Information Technology/Cybersecurity | | | | | | | | ✓ | ✓ | | |

| Investment Management/Asset Allocation | ✓ | | | | ✓ | | | | | | ✓ |

| Legal/Insurance Regulatory | ✓ | | ✓ | ✓ | ✓ | ✓ | ✓ | | ✓ | ✓ | |

| Other Public Company Board Experience | | ✓ | | | | ✓ | | | ✓ | | ✓ |

Corporate Governance

As we described in our 2021 proxy statement, our Board engaged a nationally recognized corporate governance expert as an independent consultant to review the Board’s and its committees’ composition, tenure, charters, guidelines, and processes, informed by industry corporate governance best practices. A committee of independent directors worked with the independent advisor to develop proposals to enhance our Board's ability to focus on long-term shareholder value through attention to strategy, risk, talent, metrics for prudent and active risk-taking, management oversight, and sustainability. Our Board adopted those recommendations.

Among other things, our Board:

•considers its optimum size to be seven to nine directors, plus the Chief Executive Officer;

•adopted a new retirement policy that directors will not stand for re-election at or after 75 years of age;

•expects not to nominate or appoint (or to renominate upon end of current term) any of our former employees to the Board;

•appointed only independent directors to each of the Board’s standing committees;

•established a new Audit and Risk Committee with responsibilities for our audit, information security, privacy, related person transaction, and operational, actuarial, and reputational risk oversight;

•refreshed the Nominating and Corporate Governance Committee's responsibilities to enhance its role in director nominee selection, skill development, training, and self-assessment;

•expanded the focus of the Compensation and Talent Management Committee on Chief Executive Officer and executive officer performance, evaluation, compensation, and succession, as well as on oversight of talent management, leadership, culture, and management of any risks from succession planning or compensation plans; and

•appointed an independent director to chair the Investment Committee and expanded the committee’s focus on oversight of portfolio risk.

We expect shortly to begin the process to choose a search firm to recruit director candidates, including those with a diversity of experience.

Board Leadership Structure

Mr. Mulcahy serves as Chairman of the Board of Directors

and Chair of

Monarch Materials Group, Inc., a privately-ownedour Nominating and Corporate Governance Committee, and focuses on Board effectiveness in oversight of company

which manufactures residential, basement window systems,strategy, risks, and

as President of MABSCO Capital, Inc., a privately-owned company which provides a selection of services including portfolio management, financial consulting and private placement, private equity and joint venture transactions. Mr. Mulcahy was appointed the non-executive Chairman of the Board of Workiva Inc. in June 2018 and has served as a director since its initial public offering in 2014.performance. Mr. Mulcahy is

a certified public accountant and was a partnerqualified to lead our Board in

the Des Moines officelight of

Ernst & Young LLP, where he was employed from 1976 through 1994. Mr. Mulcahy's financial expertise, knowledge and experience in accounting and business management led the Board of Directors to conclude that Mr. Mulcahy should servehis tenure as a

director of the Company.Member: Executive, AuditBoard member and Innovation & Technology Committees

A. J. Strickland, III, 78, has served as a director since 1996. He has been the Thomas R. Miller Professor of Strategic Management in the Graduate School of Business at the University of Alabama since 1969. Dr. Strickland was a director of United Security Bancshares, Inc. from 2013 to 2017 and a director of Twenty Services, Inc. until March 2014. Dr. Strickland is also the co-author of many strategic management books and texts used at universities worldwide. In addition, he conducts frequent industry and competitive analyses of domestic and international firms. Dr. Strickland's extensive knowledge of strategic management and the finance industry arising from his academic experience led the Board of Directors to conclude that Dr. Strickland should serve as a director of the Company.

Class I Directors Whose Terms Expire at the 2022 Annual Meeting

John M. Matovina, 65, has served as a director since 2000 and is serving as non-executive Chairman following his termination of employment with the Company. He has served as Chairman since April 2017 and served as Chief Executive Officer and President of the Company from 2012 until March 1, 2020 and January 27, 2020, respectively. He served as Chief Financial Officer and Treasurer of the Company from 2009 to 2012 and as the Company's Vice Chairman from 2003 to April 2017. Mr. Matovina was a private investor and a financial consultant to us from 1997 to 2003. From 1983 through 1996, he was a senior financial officer of Statesman and many of its subsidiaries, and, prior to Statesman's acquisition in 1994, he served as Statesman's Chief Financial Officer, Treasurer and Secretary. Mr. Matovina is a certifiedother public accountant and has more than 30 years of experience in the life insurance industry. Mr. Matovina's former role as Chief Executive Officer of the Companycompany board leadership, as well as his years of experienceexpertise in and extensive knowledge of the life insurance industry led the Board of Directors to conclude that Mr. Matovina should serve as a director of the Company.

Alan D. Matula, 59, has served as a director since December 2015. He has served as the Chief Information Officer of Weber-Stephen Products LLC, a privately owned company which manufactures charcoal, gas and electric outdoor grills and accessories, since December 2015. Mr. Matula worked for the Royal Dutch Shell plc organization for over 30 years. During that time, he served in various information technology capacities for the parent company and several of its subsidiaries, including chief information officer for Royal Dutch Shell plc from 2006 to 2015. Mr. Matula's experience as chief information officer overseeing technology and cyber-related risks as well as his deepaccounting, business experience led the Board of Directors to conclude that Mr. Matula should serve as a director of the Company.

Gerard D. Neugent, 68, has served as a director since 2010. He has served as Co-Chairman of Knapp Properties, L.C. since 2017 and served as Chief Executive Officer of Knapp Properties, Inc. ("Knapp Properties") from 2014 until 2020 and President from 2014 to 2017 and served as President and Chief Operating Officer of Knapp Properties from 1993 until 2014. His primary duties include real estate transactions, developmentbuilding, and management. Mr. Neugent received his law degree from Drake University. Mr. Neugent's experience in real estate and business management as well as his legal background led the Board of Directors to conclude that Mr. Neugent should serve as a director of the Company.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020 Proxy Statement |

|

5 |

Table of Contents

Board and Corporate Governance Information

Corporate Governance

The Company is committed to the highest standards of business conduct in our relationships with each other and with our customers, distributors, agents, national marketing organizations, suppliers, shareholders and others. This requires conducting our business in accordance with all applicable laws and regulations and in accordance with the highest standards of business conduct. The Company has established a Code of Business Conduct and Ethics (the "Code of Conduct") to assure uniformity in standards of conduct. The Code of Conduct applies to the Company's directors, officers and employees. The Code of Conduct is available as "Code of Conduct" under "Corporate Governance" accessible through the "Investor Relations" link on the Company's website at www.american-equity.com. A copy of the Code of Conduct is available in print. Requests should be sent to the Corporate Secretary at 6000 Westown Parkway, West Des Moines, Iowa 50266.

Board Leadership Structure

Mr. Matovina serves as Chairman of the Board of Directors. As Chairman of the Board, Mr. Matovina's focus is on the strategic direction of the Company. Mr. Matovina's former service as our Chief Executive Officer and President and his substantial industry experience make him the appropriate leader of the Board. Mr. Howe serves as Lead Independent Director and works with the Chairman and other members of the Board of Directors to provide independent oversight of the Company. Among other things, Mr. Howe serves as principalMulcahy coordinates liaison among the Chairman, the independent directors and senior management. Mr. Howe alsomanagement and chairs executive sessions of the independent directors.

Beginning in 2021, only independent directors are members of - and

non-management directors.serve as the chair of - each of our Board committees. This promotes objective and effective committee oversight of Directors' Oversightmanagement and achievement of Risk Management

The Company'sthe roles and goals our Board of Directors administers its risk oversight function directlyhas assigned each committee.

Director Independence

Our Board considers a director independent only if the director has no material relationship with us and through its committees. our affiliates and is otherwise independent under New York Stock Exchange rules. Our Nominating and Corporate Governance Committee has adopted Categorical Standards on Director Independence, available on our website (www.american-equity.com), as guidelines for determining whether a relationship is material.

The Board

of Directors participates in settingfound Mr. Matula, Mr. Neugent, Ms. Chapman, Ms. Cushing, Mr. Healy, Mr. Howe, Mr. Mulcahy, and Mr. A.J. Strickland III (who is serving as a director until the

Company's business strategy and plays a key role in the assessment of management's approach to risk. Through this process,annual shareholder meeting) independent. In so doing, our Board considered that Mr. Mulcahy serves on the Board of Directors

better understandsof Workiva and

determines what levelis a less than 1% owner of

risk is appropriatethat company. Workiva provides software and related services to us for

the Company. While the Board of Directors has the ultimate oversight responsibility for the risk management process, various committees of the Board of Directors also have responsibility for risk management. For example, the Audit Committee focuses on financial reporting risk, including internal controls. The Risk Committee focuses on non-financial risks, liquidity riskdrafting, managing, and

insurance risk. Additionally, the Compensation Committee is responsible for creating incentives that encourage a level of risk-taking behavior consistentfiling information with the

Company's business strategy. Finally, the Investment Committee focuses on credit risk and market risk and investment policies and activities.The responsibility for the day-to-day management of risk lies with the Chief Executive Officer and our management. The Company has an enterprise risk management ("ERM") policy approved by the Board of Directors and implemented by an ERM Committee comprised of the Chief Risk OfficerSEC and other members of senior management who, among other things, review and discuss reports from other members of management regarding the Company's risk management activities, including the areas management has identified as our major risk exposures, and the steps taken to monitor and manage those exposures. The Chief Executive Officer, Chief Risk Officer and ERM Committee are responsible for reporting the risk profile, risk trends and key risk metrics to the Risk Committee.

The Company hasaccounting practices. Our Board also considered that Mr. Neugent is a Disclosure Committee comprised of (i) the Audit Committee Chair, who also serves as Chairman for the Disclosure Committee, (ii) the Chief Financial Officer, (iii) the Chief Accounting Officer and (iv) the General Counsel of the Company. The purpose of the Disclosure Committee is to assist senior officers of the Company in fulfilling the Company's and their responsibilities regarding the identification and disclosure of material information about the Company and the accuracy, completeness and timeliness of the Company's financial reports, SEC reports and press releases.

director, manager,

|

|

|

|

|

|

|

|

|

|

|

20202022 Proxy Statement |

|

|

|

|

|

|

Table of Contents

Majority of Independent Directors

Our Board of Directors presently includes twelve members

officer, and

it has affirmatively determined the following ten are independent under applicable requirements:Joyce A. Chapman

Brenda J. Cushing

James M. Gerlach

Robert L. Howe

William R. Kunkel

Alan D. Matula

David S. Mulcahy

Gerard D. Neugent

Debra J. Richardson

A. J. Strickland, III

The Board has also determined that Michelle M. Keeley, who is nominated for election, is independent under the applicable requirements.

Gerard D. Neugent is the Co-Chairmanan owner of Knapp Properties, L.C. which directly or through its affiliate, Knapp Properties,Properties. That firm provides property management services tofor the (unaffiliated) owner of the building where the Company has its principal executive offices in West Des Moines, Iowa.American Equity office space. The aggregate amountfirm’s fee is 4% of fees paid to Knapp Properties by the owner of the building with respect to the Company's offices is immaterial in amount to both the Company and to Knapp Properties.gross rent. Mr. Neugent is also a member/member and manager of William C. Knapp L.C., which isLC, a 50% owner of West Lake Properties, L.C. West Lake Properties, L.C. ownsproperty where we lease warehouse space. In no case does the director have a warehouse building,material interest in the transactions with us.

Board and Committee Meetings

Each director attended at least 75% of our Board meetings and meetings of any Board committee on which the director served in 2021. All directors attended the 2021 annual shareholder meeting. We expect each of our directors to attend our 2022 Annual Shareholder Meeting.

| | | | | |

| Meetings

During 2021 |

| Board of Directors | 6 |

Audit and Risk Committee (1) | 10 |

Compensation and Talent Management Committee (2) | 12 |

| Nominating and Corporate Governance Committee | 5 |

| Investment Committee | 5 |

(1) Includes both of its predecessors, the Audit Committee and the Risk Committee.

(2) Includes its predecessor, the Compensation Committee.

The Board as a

portion of which is leased towhole took on the

Company. The aggregate amount of rent and expenses relating to the warehouse space is immaterial in amount to both the Company and William C. Knapp, L.C.David S. Mulcahy is the non-executive Chairmanformer responsibilities of the Board, a directorInnovation and shareholder of Workiva Inc. The Company has entered into a subscription agreement with Workiva Inc. to utilize certain software. The fees paid to Workiva Inc. in 2019 pursuant to the subscription agreement are immaterial to the CompanyTechnology Committee and to Workiva Inc.

The independent directors meet in executive sessionExecutive Committee during 2021; as a partresult, neither committee met during the year.

Board of all regular quarterly meetingsDirectors’ Oversight of theRisk Management

Our effective risk management is fundamental to delivery of long-term value to shareholders, policyholders, and other stakeholders. Our Board of Directors oversees our strategy and risk management, as partwell as the alignment of other meetingsone with the other.

Each of our Board committees has a crucial role in risk management oversight:

•The Audit and Risk Committee plays a central role overseeing our risk management governance structure, risk management taxonomy, risk appetite, and risk assessment guidelines for the identification and review of risks that could have a material impact on us.

•The Nominating and Corporate Governance Committee oversees governance risk management through its director succession planning, director nominee selection, and director education.

•The Compensation and Talent Management Committee oversees our management of risks relating to our compensation arrangements, including how we avoid creating incentives to take excessive or inappropriate risks, as well as risks from continuity and orderly succession planning of our senior management.

•The Investment Committee oversees risks related to our investment portfolio, including investment risk limits, risk appetite, and risk guidelines.

Board Committees

Nominating and Corporate Governance Committee

The committee consists entirely of independent directors. The committee:

•assesses the skills, backgrounds, experience, independence, and expertise the board needs and identifies and recommends director nominees to the Board;

•establishes a director orientation program;

•reviews and advises our Board on ongoing director independence and conflicts of interest;

•develops and recommends corporate governance principles to our Board;

•coordinates the Board and committee’s oversight of environmental, social and governance issues;

•reviews and recommends compensation of the Corporation’s independent directors to the Board;

•oversees the administration of our securities trading policies;

•oversees the completion of director and officer questionnaires;

•reviews the Board’s leadership structure; and

•conducts an annual Board and committee assessment.

See also "Board of Directors when warranted. At each executive session,Directors’ Oversight of Risk Management," above.

You can find the

Lead Independent Director presides. The Board of Directors has adopted Corporate Governance Guidelines, which are available as "Guidelines"committee's charter under "Corporate Governance" accessible through the "Investor Relations" link on our website at

www.american-equity.com and arewww.american-equity.com. The charter is also available in print for any shareholder upon request.

Any interested parties desiring

Compensation and Talent Management Committee

The committee consists entirely of independent directors. The committee:

•reviews and approves compensation-related corporate goals and objectives for our Chief Executive Officer and other executive officers, evaluates their performance against such goals, and recommends their compensation for determination by our Board’s independent directors;

•when appropriate, assists our Board in recruiting a new Chief Executive Officer and in establishing related continuity, orderly succession, and contingency succession planning;

•oversees our short-term and long-term incentive plans and equity-based plans;

•oversees management’s processes and systems to communicate withattract, recruit, hire, train, develop, promote, and retain a member (or all members)talented and diverse workforce, and for the continuity and orderly succession of senior management; and

•reviews and approves its report and the Compensation Discussion & Analysis, each of which is included in this proxy statement.

See also "Board of Directors’ Oversight of Risk Management," above.

The committee has engaged Pearl Meyer & Partners, an independent compensation consultant (Pearl Meyer). Pearl Meyer provided advice, compensation benchmarking and market practice data. The committee reviewed information from Pearl Meyer addressing its independence and the independence of the Boardteam directly serving the committee. This included the nature of Directors regarding the Company may directly contact such directors by mail or electronically. To communicate with the Board of Directors, any individual director or any group or committee of directors, correspondence should be addressedits services to us other than to the committee or Board (which was none), our fees in relation to its total revenue, its conflict of Directorsinterest policies and procedures, and any relevant business or personal relationships or stock ownership including the independence factors set forth in Exchange Act Rule 10C-1. We believe that the firm’s work has not raised any such individual director or group or committeeconflict of directors by either name or title. All mail correspondence should be sent to the Corporate Secretary at 6000 Westown Parkway, West Des Moines, Iowa 50266. All electronic correspondence should be sent to the Corporate Secretary at corpsecretary@american-equity.com. All correspondence received by the Corporate Secretary will be categorized and then forwarded to the Board of Directors, the individual director or any group or committee of directors. Meetings and Committees of the Board of Directors

The Board of Directors met twelve times in 2019, and each of the directors attended at least 75% of the meetings of the Board of Directorsinterest and the committee meetings for any committee on which he or she served during 2019. We currently have seven permanent committees, as described below. Under our Corporate Governance Guidelines, a

firm is independent.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020 Proxy Statement |

|

7 |

Table of Contents

director is invited and encouraged to attendYou can find the Annual Meeting. All directors, with the exception of A. J. Strickland, III attended the 2019 Annual Meeting of Shareholders.

| | | | | | |

| | | | | |

Board Committee

| | Current Members

| | Meetings

During 2019

| |

|---|

| | | | | |

Audit

| | Cushing, Howe, Mulcahy | | 8 | |

| | | | | |

Compensation

| | Chapman, Cushing, Strickland | | 7 | |

| | | | | |

Nominating & Corporate Governance

| | Chapman, Gerlach, Neugent | | 7 | |

| | | | | |

Executive

| | Bhalla(1), Howe, Matovina, Mulcahy | | 1 | |

| | | | | |

Investment

| | Bhalla(1), Howe, Matovina, Mulcahy | | 4 | |

| | | | | |

Risk

| | Kunkel, Matula, Richardson(2) | | 4 | |

| | | | | |

Innovation & Technology

| | Matula, Mulcahy, Strickland | | 2 | |

| | | | | |

(1)Mr. Bhalla was appointed to the Board of Directors and became a member of the Executive and Investment Committees on January 27, 2020.

(2)Ms. Richardson, who presently serves as a Class II Director, will not stand for reelection at the Annual Meeting.

TheAudit Committee performs the following functions, among others: (i) assists the Board of Directors' oversight of (a) the integrity of our financial statements and systems of internal control over financial reporting; (b) our compliance with legal and regulatory requirements as they pertain to the financial statements and annual audit process; (c) our independent registered public accounting firm's qualifications and independence; and (d) the performance of our independent registered public accounting firm and our internal audit function; and (ii) prepares the annual report on audit disclosures required to be prepared by the Audit Committee pursuant to the rules of the SEC. The Audit Committee is governed by a writtencommittee's charter approved by the Board of Directors. The charter is available under "Corporate Governance" accessible through the "Investor Relations" link on our website at www.american-equity.com andwww.american-equity.com. The charter is also available in print for any shareholder upon request. The annual report

Compensation and Talent Management Committee Interlocks and Insider Participation

None of

the Audit Committee is set forth below.The Audit Committee must include only directors who satisfy the independence requirements under SOXour Compensation and the NYSE Rules. In addition, all AuditTalent Management Committee members must havehas ever been an officer or employee of ours or any of our subsidiaries. During our last fiscal year, none of our executives served on the abilitycompensation committee or board of directors of any company that had any executive officers who served on our Board of Directors or our Compensation and Talent Management Committee.

Audit and Risk Committee

The committee consists entirely of independent directors. All committee members are able to read and understand financial statements. The Board of Directors has determined that all members of the Audit Committee meet the applicable standards. In addition, the Board of Directors has determined that Ms. Cushing, Mr. Healy, Mr. Howe, and Mr. MulcahyMatula are "audit committee financial experts," as that term is defined under SOX.TheUnited Stated Securities and Exchange Commission (Compensation CommitteeSEC performs ) rules. The committee oversees:

•the following functions, among others: (i) oversees the compensationintegrity of our financial statements;

•our compliance with legal and benefit plansregulatory requirements pertaining to financial statements and practices related to the Company's Chief Executive Officer; (ii) oversees the compensation payable to those executive officers identified in the Company's proxy statement who report directly to the Chief Executive Officer; (iii) administers the Company's compensation plans including cash incentiveannual audit process;

•our independent auditors' qualifications and equity-based plans; (iv)independence, and performance;

•our independent auditors and internal audit function; and

•many aspects of our our risk management. See "Board of Directors’ Oversight of Risk Management," above.

The committee also reviews and recommends toapproves its report included in this proxy statement. You can find the Board of Directors the compensation of the Company's non-employee directors; and (v) produces an annual report on executive compensation required to be prepared by the Compensation Committee pursuant to the rules of the SEC. The Compensation Committee is governed by a writtencommittee's charter approved by the Board of Directors. The charter is available under "Corporate Governance" accessible through the "Investor Relations" link on our website at www.american-equity.com andwww.american-equity.com. The charter is also available in print for any shareholder upon request. The annual report of the Compensation Committee is set forth below.

The Compensation Committee has the authority to engage compensation consultants, independent legal counsel and other advisers as it deems necessary. The Compensation Committee has engaged Pearl Meyer & Partners, an independent compensation consultant ("Pearl Meyer"), to provide advice and data with respect to compensation benchmarking and market practices. In 2019, Pearl Meyer advised the Compensation Committee regarding (i) base salaries of executive officers, (ii) short-term incentive compensation awards and (iii) long-term incentive compensation awards. In performing the annual assessment of the compensation consultant's independence, the Compensation Committee has reviewed, among other items, a letter from Pearl Meyer addressing its independence and the independence of the members of the consulting team serving the Compensation Committee, including the following factors: (i) the nature of any services provided to the Company by Pearl Meyer other than as described above; (ii) the amount of fees paid by the Company in relation to Pearl Meyer's total revenue; (iii) Pearl Meyer's policies and procedures designed to prevent conflicts of interest; and (iv) the existence of any business or personal relationship or stock ownership that could impact the adviser's independence. Pursuant to SEC and NYSE Rules, the Compensation Committee assessed the independence of Pearl Meyer in February 2019 and determined Pearl

Investment Committee

|

|

|

|

|

|

|

|

|

8 |

|

2020 Proxy Statement |

|

|

|

|

|

|

Table of Contents

Meyer is independent from the Company's management and that no conflict of interest exists that would prevent Pearl Meyer from serving as an independent consultant for the Compensation Committee.

Under the NYSE Rules, the Compensation Committee must be composedThe committee consists entirely of independent directors. The Boardcommittee oversees our investment strategies, objectives, policies, practices and activities, including the performance of Directors has determined that all membersany third party investment sub-advisors. See also "Board of the Compensation Committee meet the applicable standard.

TheNominating and Corporate Governance Committee performs the following functions, among others: (i) identifies and recommends to the BoardDirectors’ Oversight of Directors individuals qualified to serve as directorsRisk Management," above.

Director Policies; Code of the Company; (ii) develops and recommendsEthics

Our Board's corporate governance principles forguidelines assist it in exercising its responsibilities, and are designed to promote Board and committee effectiveness. You can find the Company as required by law; (iii) oversees the Chief Executive Officer succession planning process; and (iv) oversees the evaluation of the Board of Directors as a whole and the Company's management. The Nominating and Corporate Governance Committee is governed by a written charter approved by the Board of Directors. The charter is availableguidelines under "Corporate Governance" accessible through the "Investor Relations" link on our website at www.american-equity.comwww.american-equity.com.

We require each independent director to own common stock of at least three times the annual director cash retainer. Directors must retain at least 75% of the net after-tax shares from the vesting, settlement or exercise of equity awards until they meet the stock ownership level. We measure stock ownership annually at year-end using the highest price within the past twelve (12) months. Each of our independent directors has met the stock ownership requirements.

We prohibit our directors from pledging, hedging, or similar arrangements for our common stock that lock in value without the full risks and

isrewards of stock ownership. We also

availableprohibit them from buying our common stock on margin or borrowing against any account in

print for anywhich they own our common stock. In so doing, we aim to preserve the shareholder

upon request.Under the NYSE Rules,alignment from their stock ownership.

Our director conflict of interest policy provides guidance to directors on how to recognize an actual, apparent, or potential conflict; how to disclose it to us; and how to proceed in light of an actual, apparent, or potential director conflict of interest. It also describes how the Nominating and Corporate Governance Committee must be composed entirelywill review and act on a reported conflict of independent directors.interest, and what actions and remedies it may recommend our Board implement. As such, it provides the framework for directors, the committee, and the Board to address such situations promptly, consistently, and manner designed to protect us and our shareholders

We have established a Code of Business Conduct and Ethics for our directors, chief executive officer, chief financial officer, chief accounting officer, other officers, and employees. The code explains how we expect everyone to conduct our business and how to determine the right choices when presented with an ethical problem. You can find the code under "Corporate Governance" through the "Investor Relations" link on the Company’s website at www.american-equity.com. You may request a printed copy of the Code of Conduct from our Corporate Secretary by mail at 6000 Westown Parkway, West Des Moines, Iowa 50266.

Related Person Transaction Disclosures

We and our corporate affiliates enter into or continue related person transactions, as defined in SEC rules, only when our Board of Directors has determinedapproves as described below. No director participates in any review of any transaction where that alldirector or any immediate family members is the related person.

Our legal counsel advises the Board whether a proposed or amended transaction is a related person transaction. If so, our management or the related person submits the proposed transaction or amendment to the Audit and Risk Committee. The committee (or the chair, where awaiting full committee consideration would be impracticable), considers any facts and circumstances it determines relevant, such as the benefits to us, any impact on a director’s independence, the availability of other suppliers or customers, the terms of the transaction; and terms available to unrelated third parties or to customers generally. The committee approves the transaction only if it determines it is in, or not inconsistent with, our and our shareholders best interests.

In addition, each first calendar quarter, the committee reviews any existing related person transactions that have a remaining term of more than six months or remaining amounts payable to or receivable from the Company of more than $120,000. The committee determines if it is in our and our shareholders' best interests for the transaction to continue.

BlackRock, Inc. has publicly disclosed a greater than 5% beneficial interest in our common stock. During 2021, we paid BlackRock, Inc. fees of $8,130,594 for investment management services and to license a risk management analytics tool.

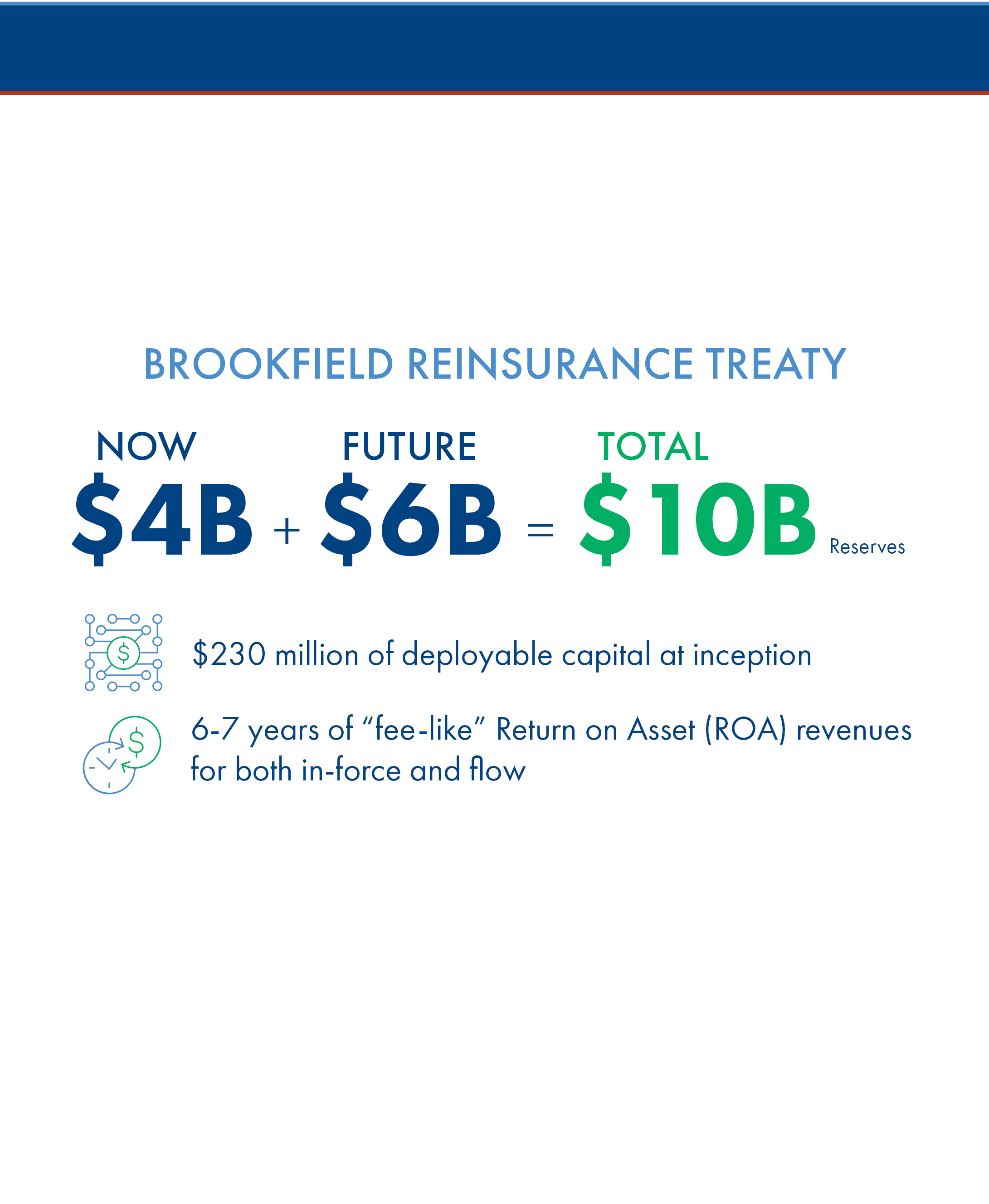

Brookfield Asset Management Reinsurance Partners Ltd. has publicly disclosed a greater than 5% beneficial interest in our common stock. Mr. Shah is an employee or officer of one or more of it and its affiliates (together, Brookfield). We have reinsurance and investment management arrangements with Brookfield. We received $4,231,057,388 in asset management fees and ceding commissions in exchange for premiums ceded net of benefits paid from Brookfield in 2021. In addition, in accordance with the terms of an agreement established in October, 2020, Brookfield purchased 6,775,000 shares of our common stock at $37.33 per share, for a total price of $252,910,750.

Director Compensation

We paid the following 2021 compensation to our non-employee directors:

| | | | | | | | | | | |

| Name | Fees Earned or

Paid in Cash

($) | Stock Awards ($) | Total

($) |

| Joyce A. Chapman | 96,000 | 96,007 | 192,007 |

| Brenda J. Cushing | 120,500 | 96,007 | 216,507 |

| James M. Gerlach | 86,000 | 96,007 | 182,007 |

| Douglas T. Healy | 90,000 | 96,007 | 186,007 |

| Robert L. Howe | 99,250 | 96,007 | 195,257 |

| Michelle M. Keeley | 90,500 | 96,007 | 186,507 |

| William R. Kunkel | 92,000 | 96,007 | 188,007 |

| Alan D. Matula | 93,750 | 96,007 | 189,757 |

| David S. Mulcahy | 194,000 | 96,007 | 290,007 |

| Gerard D. Neugent | 85,000 | 96,007 | 181,007 |

John M. Matovina (1) | 95,500 | 96,007 | 191,507 |

Sachin Shah (2) | 80,000 | 96,007 | 176,007 |

| A.J. Strickland, III | 97,250 | 96,007 | 193,257 |

(1)Mr. Matovina served for a portion of 2021.

(2)Mr. Shah has assigned his compensation to Brookfield.

Our Nominating and Corporate Governance Committee

meet the applicable standard.TheExecutive Committee performs the following functions, among others: (i) except as prohibited by applicable law, exercises, between meetings of our Board of Directors, all of the powers and authority ofuses the Board of Directors; (ii) reviews corporate matters presented, orDirector’s independent compensation consultant, Pearl Meyer, for non-employee director compensation data and advice. Pearl Meyer provided a report in May 2021 to be presented,the (then-named) Compensation Committee, which determined director compensation at the time. The report recommended increases in non-employee director compensation (which had been targeted at the 25th percentile of our peer group in recent years) based on Pearl Meyer's evaluation of peer group compensation practices and data.

We pay each non-employee director:

•a $20,000 per quarter cash retainer; and

•an annual restricted stock grant with a value of approximately $96,000. In the table above, we report each restricted stock award at the $31.78 Financial Accounting Standards Board Accounting Standards Codification Topic 718 (ASC 718) grant date fair value (Grant Date Fair Value). For further information, please see Note 13 to the Consolidated Financial Statements in our Annual Report for 2021 on Form 10-K (our 2021 10-K). On June 10, 2021, we granted each director in the table above 3,021 shares of restricted stock. Ms. Keeley resigned from our board in 2022 and forfeited her award; all other shares remained outstanding as of year-end 2021 and are scheduled to vest on June 10, 2022.

We pay our independent Chairman an additional $30,000 fee per quarter.

Committee chairs and members earn (or earned) the following additional quarterly fees prorated for service for a portion of a quarter):

| | | | | | | | |

| Chair

($) | Other Members

($) |

| Current Committees: |

| Audit and Risk | 10,500 | 3,000 |

| Compensation and Talent Management | 3,750 | 1,500 |

| Investment | 3,000 | 1,000 |

| Nominating and Corporate Governance | 3,000 | 1,000 |

| | |

| Predecessor and Eliminated Committees: |

| Audit | 10,500 | 3,000 |

| Compensation | 3,750 | 1,500 |

| Innovation and Technology | 2,250 | 750 |

| Risk | 3,000 | 1,000 |

We did not grant any non-employee directors any stock options in 2021. As of year-end 2021, Ms. Chapman, Mr. Howe, and Mr. Neugent each held 14,000 exercisable stock options as a result of awards we granted our non-employee directors in earlier years.

Selection of Director Nominees

In selecting nominees for election to our Board,

of Directors; and (iii) makes recommendations to the

Board of Directors on policy matters.TheInvestment Committee performs the following functions, among others: (i) oversees our general investment strategies, objectives, standards and limitations; (ii) oversees our use of derivatives and general hedging strategy; and (iii) reviews and monitors investment performance. The Investment Committee is governed by a written charter approved by the Board of Directors.

TheRisk Committee performs the following functions, among others: oversight of the Company's (i) risk management governance structure; (ii) risk management taxonomy and risk assessment guidelines for risks that could have a material impact on the Company; and (iii) risk tolerance. The Risk Committee is governed by a written charter approved by the Board of Directors.

TheInnovation and Technology Committee reviews, evaluates and makes recommendations concerning the Company's innovation and technology strategy and capabilities in light of the Company's long-term business strategy and goals.

Information Regarding the Company's Process for Identifying Director Nominees

The Company is committed to having a Board of Directors comprised of individuals who are accomplished in their fields, have the ability to make meaningful contributions to the Board of Directors' oversight of the business and affairs of the Company and have an impeccable record and reputation for honest and ethical conduct. The Nominating and Corporate Governance Committee will consider candidates recommended by shareholders. In considering candidates submitted by shareholders, the Nominatinga candidate's background and Corporate Governance Committee will take into consideration the needsqualifications, including experience, skills, expertise, diversity, integrity, character, business judgment, time availability in light of the Boardother commitments, dedication, conflicts of Directors and the qualifications of the candidate. The Nominating and Corporate Governance Committee may also take into consideration the number of shares held by the recommending shareholder and the length of time the shares have been held.